SOLO RAPPORTERINGSSKEMAER

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.04.02 Information on class 10

-

S.04.03 Basic Information – list of underwriting entities

-

S.04.04 Activity by country – location of underwriting

-

S.04.05 Activity by country – location of risk

-

S.05.01 Prem., claims & exp. – lobs

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.06.04 Climate change-related risks to investments

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.12.01 Life & health SLT TP

-

S.12.02 Life TP – by country

-

S.13.01 Cash flows – life

-

S.14.01 Life obligations analysis

-

S.14.02 Non-Life obligation analysis

-

S.14.03 Cyber underwriting risk

-

S.16.01 Ann. stemming from non-life

-

S.17.01 Non-life & health NSLT TP

-

S.17.03 Non-Life Technical Provisions – By country

-

S.18.01 Cash flows – non-life

-

S.19.01 Non-life claims triangles

-

S.20.01 Movements of RBNS claims

-

S.21.01 Loss distrib. profile – non-life

-

S.21.02 Underwriting risks – non-life

-

S.21.03 Non-life mass risks

-

S.22.01 LTG and Transitional Measures

-

S.22.04 Information on the transitional on interest rates calculation

-

S.22.05 Overall calculation of the transitional on technical provisions

-

S.22.06 BE subject to volatility adjustment by country and currency

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.28.01 MCR – Non-composites

-

S.28.02 MCR – Composites

-

S.29.01 AoM – Excess of assets over liab.

-

S.29.02 AoM – Investments & fin liabilities

-

S.29.03 AoM – TP

-

S.29.04 AoM – Technical flows vs TP

-

S.30.01 Facultative covers – basic

-

S.30.02 Facultative covers – shares

-

S.30.03 Reinsurance program – basic

-

S.30.04 Reinsurance program – shares

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

KONCERN RAPPORTERINGSSKEMAER

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.05.01 Premiums, claims and expenses by line of business

-

S.05.02 Premiums, claims and expenses by country

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.22.01 LTG and Transitional Measures

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.32.01 Undertakings in the scope of the group

-

S.33.01 Insurance and Reinsurance individual requirements

-

S.34.01 Other regulated and non-regulated financial undertakings

-

S.35.01 Contribution to group Technical Provisions

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

-

S.37.01 Risk concentration - Exposure to Counterparties

-

S.37.02 Risk concentration - Exposure by currency, sector, country

-

S.37.03 Risk concentration - Exposure by asset class and rating

LOVGIVNING

GUIDELINES

-

Forsikringsmæssige hensættelser

-

Kontraktsgrænser

-

Legal Entity Identifier

-

PEPP tilsynsrapportering

-

IT and Communication Security and Governance

-

Outsourcing til cloud service providers

-

Forberedende: Product oversight and governance arrangements by insurance undertakings and distributors

-

IDD: forsikringsbaserede investeringsprodukter

-

Risikofaktorer

-

Prudential Assessment of Acquisitions of Holdings in the Financial Sectors

-

Dialog mellem tilsyn og revisorer

-

Tilsyn med filialer af tredjelande-forsikringsselskaber

-

Errata: Tilsyn med filialer af tredjelande-forsikringsselskaber

-

Finansiel Stabilitet (14 September 2015)

-

Finansiel stabilitet (18 June 2017)

-

Finansiel Stabilitet (31 December 2023)

-

Forlængelse af recovery perioden

-

Long-term guarantee measures

-

Determining the market shares for reporting

-

Rapportering og offentliggørelse

-

Aktiver og forpligtelser, som ikke er forsikringstekniske hensættelser

-

Own Risk Solvency Assessment (ORSA)

-

Exchange of information within colleges

-

Health catastrophe risk sub-module

-

Look-through tilgang

-

Operational functioning of colleges

-

Ring-fenced funds

-

Supervisory review process

-

Loss-absorbing capacity for the SCR

-

Equivalence assessments by NSAs under SII

-

Market and counterparty exposures in the standard formula

-

Use of internal models

-

Treatment of related undertakings, including participations

-

Undertaking-Specific Parameters

-

Klassifikation af kapitalgrundlaget

-

Koncern solvens

-

Ancillary Own Funds

-

Application of Outwards Reinsurance

-

Application of the Life Underwriting Module

-

Basis Risk

-

System of Governance

Rapporteringsværktøj

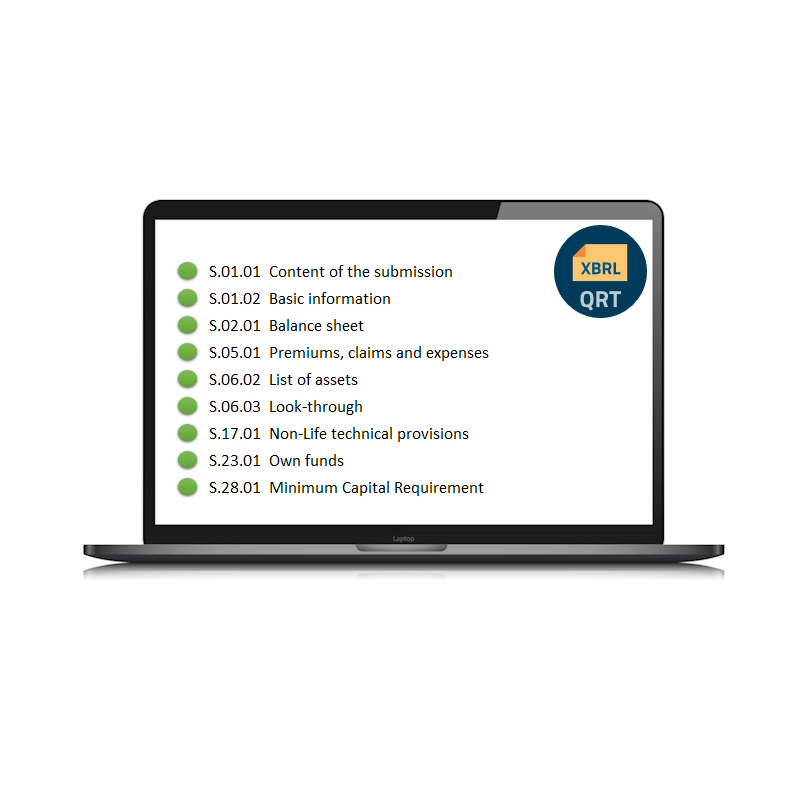

Vores værktøj til rapportering under Solvens II, **QRT-Tool**, kommer med **al den service og support du har brug for**. Og med stamme deadlines er det super vigtigt at kunne få det rette råd til at løse problemet med din rapportering til Tilsynet. Vi giver vores support per telefon, via emails eller med onlinemøder og vi er endvidere ofte tilgængelige på tidspunkter du aldrig havde forventet.

SCR beregningsværktøj

Vores værktøj til at beregne solvenskapitalkravet under Solvens II, **SCR-Tool**, er intuitivt og enkel at bruge. SCR-Tool kommer med et kraftfuldt overblik, og du kan nemt bore ned i enhver komponent af regnestykket. Du kan se formlerne, og resultaterne præsenteres nøjagtigt det format, som bruges i QRT'erne. Intet er skjult.

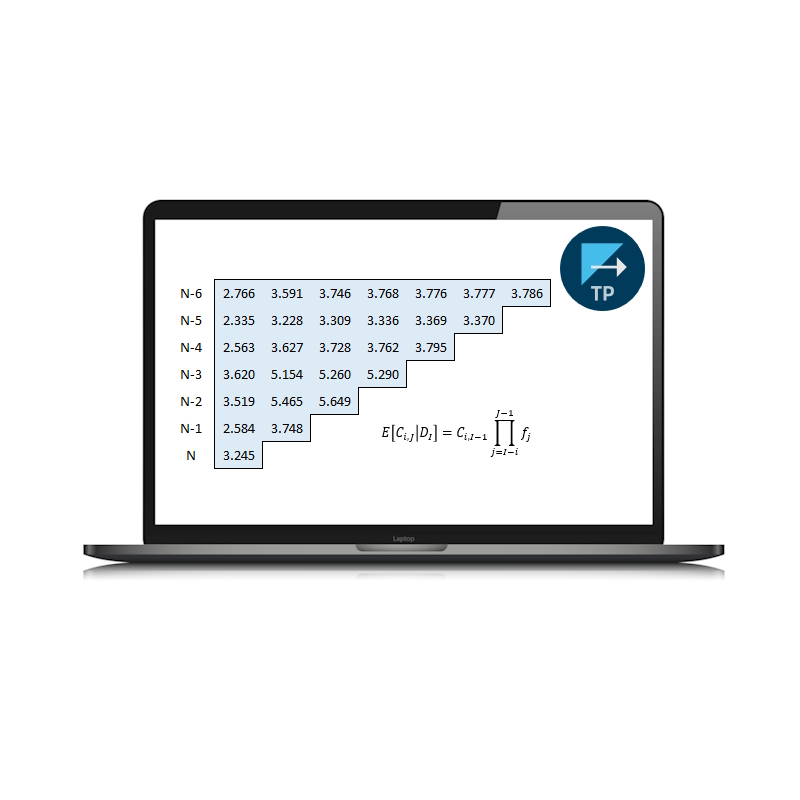

Reserveringsværktøj

Vores værktøj til beregning af tekniske hensættelser, ReservingTool, er lavet til at udføre en masse praktisk arbejde. Så du kan gøre processerne endnu hurtigere til beregning af IBNR, diskontering, værdiansættelse af skadesbehandlingsreserver og meget mere. Du kan endda lynhurtigt udfylde en lang række komplicerede rapporteringsskabeloner med den automatiske QRT-Generator.

IORP tool

Alt hvad du kan gøre, kan du gøre bedre. Dette kan også gælde for dine rapporteringsrutiner. Vores IORP-Tool giver dig mulighed for at rapportere under IORP og på enkel vis skabe XBRL-filer til tilsynsmyndighederne.