SOLO RAPPORTMALER

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.04.02 Information on class 10

-

S.04.03 Basic Information – list of underwriting entities

-

S.04.04 Activity by country – location of underwriting

-

S.04.05 Activity by country – location of risk

-

S.05.01 Prem., claims & exp. – lobs

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.06.04 Climate change-related risks to investments

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.12.01 Life & health SLT TP

-

S.12.02 Life TP – by country

-

S.13.01 Cash flows – life

-

S.14.01 Life obligations analysis

-

S.14.02 Non-Life obligation analysis

-

S.14.03 Cyber underwriting risk

-

S.16.01 Ann. stemming from non-life

-

S.17.01 Non-life & health NSLT TP

-

S.17.03 Non-Life Technical Provisions – By country

-

S.18.01 Cash flows – non-life

-

S.19.01 Non-life claims triangles

-

S.20.01 Movements of RBNS claims

-

S.21.01 Loss distrib. profile – non-life

-

S.21.02 Underwriting risks – non-life

-

S.21.03 Non-life mass risks

-

S.22.01 LTG and Transitional Measures

-

S.22.04 Information on the transitional on interest rates calculation

-

S.22.05 Overall calculation of the transitional on technical provisions

-

S.22.06 BE subject to volatility adjustment by country and currency

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.28.01 MCR – Non-composites

-

S.28.02 MCR – Composites

-

S.29.01 AoM – Excess of assets over liab.

-

S.29.02 AoM – Investments & fin liabilities

-

S.29.03 AoM – TP

-

S.29.04 AoM – Technical flows vs TP

-

S.30.01 Facultative covers – basic

-

S.30.02 Facultative covers – shares

-

S.30.03 Reinsurance program – basic

-

S.30.04 Reinsurance program – shares

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

GRUPPERAPPORTMALER

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.05.01 Premiums, claims and expenses by line of business

-

S.05.02 Premiums, claims and expenses by country

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.22.01 LTG and Transitional Measures

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.32.01 Undertakings in the scope of the group

-

S.33.01 Insurance and Reinsurance individual requirements

-

S.34.01 Other regulated and non-regulated financial undertakings

-

S.35.01 Contribution to group Technical Provisions

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

-

S.37.01 Risk concentration - Exposure to Counterparties

-

S.37.02 Risk concentration - Exposure by currency, sector, country

-

S.37.03 Risk concentration - Exposure by asset class and rating

REGELVERK

RETNINGSLINJER

-

Valuation of Technical Provisions

-

Contract Boundaries

-

Legal Entity Identifier

-

PEPP supervisory reporting

-

IT and Communication Security and Governance

-

Outsourcing to cloud service providers

-

Preparatory: Product oversight and governance arrangements by insurance undertakings and distributors

-

IDD: Insurance-based investment products

-

Risk Factors

-

Prudential Assessment of Acquisitions of Holdings in the Financial Sectors

-

Dialogue between Insurance Supervisors and Statutory Auditors

-

Supervision of branches of thirdcountry insurance undertakings

-

Errata: Supervision of branches of third country insurance undertakings

-

Financial Stability (14 September 2015)

-

Financial stability (18 June 2017)

-

Financial Stability (31 December 2023)

-

Extension of the Recovery Period

-

Long-term guarantee measures

-

Determining the market shares for reporting

-

Reporting and public disclosure

-

Valuation of assets and liabilities other than TP

-

Own Risk Solvency Assessment (ORSA)

-

Exchange of information within colleges

-

Health catastrophe risk sub-module

-

Look-through approach

-

Operational functioning of colleges

-

Ring-fenced funds

-

Supervisory review process

-

Loss-absorbing capacity for the SCR

-

Equivalence assessments by NSAs under SII

-

Market and counterparty exposures in the standard formula

-

Use of internal models

-

Treatment of related undertakings, including participations

-

Undertaking-Specific Parameters

-

Classification of Own Funds

-

Group Solvency

-

Ancillary Own Funds

-

Application of Outwards Reinsurance

-

Application of the Life Underwriting Module

-

Basis Risk

-

System of Governance

Rapporteringsverktøy

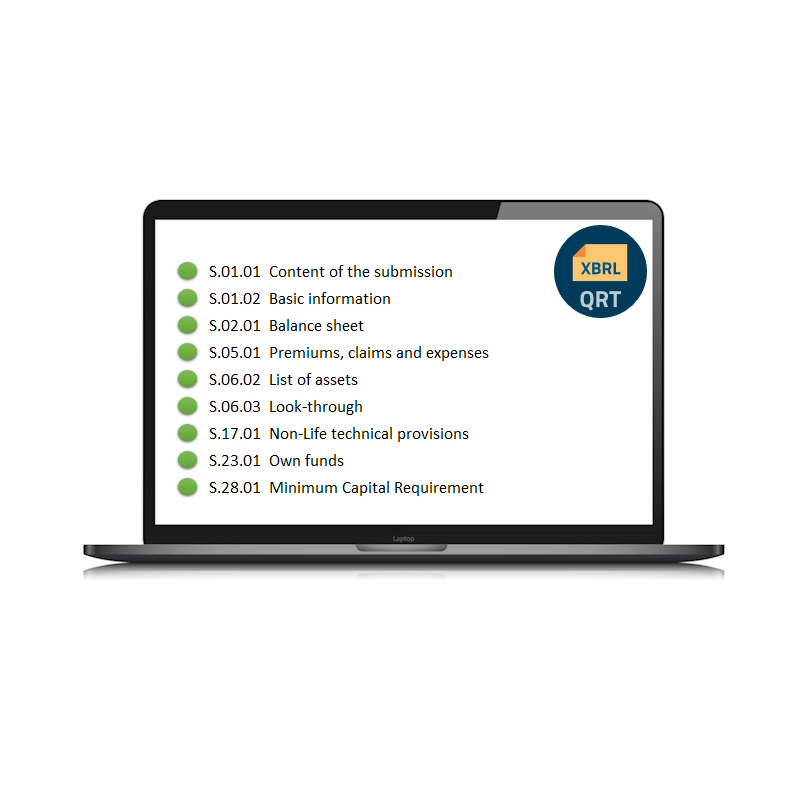

Vårt verktøy for rapportering under Solvency II, QRT-verktøyet, kommer med all service og støtte du trenger. Og med korte tidsfrister er det ekstra viktig å få riktig rådgivning for å løse problemer med din rapportering til finanstilsynet. Vi tilbyr støtte via telefon, e-post eller nettmøter, og vi er ofte tilgjengelige på tider du aldri hadde forventet.

SCR-beregningsverktøy

Vårt verktøy for å beregne Solvency Capital Requirement under Solvency II, SCR-verktøyet, er intuitivt og enkelt å bruke. SCR-verktøyet gir en kraftig oversikt, og du kan enkelt dykke ned i enhver komponent av beregningen. Du kan se formlene, og resultatene presenteres nøyaktig i det formatet som brukes i QRT-ene. Ingenting er skjult.

Reserveringsverktøy

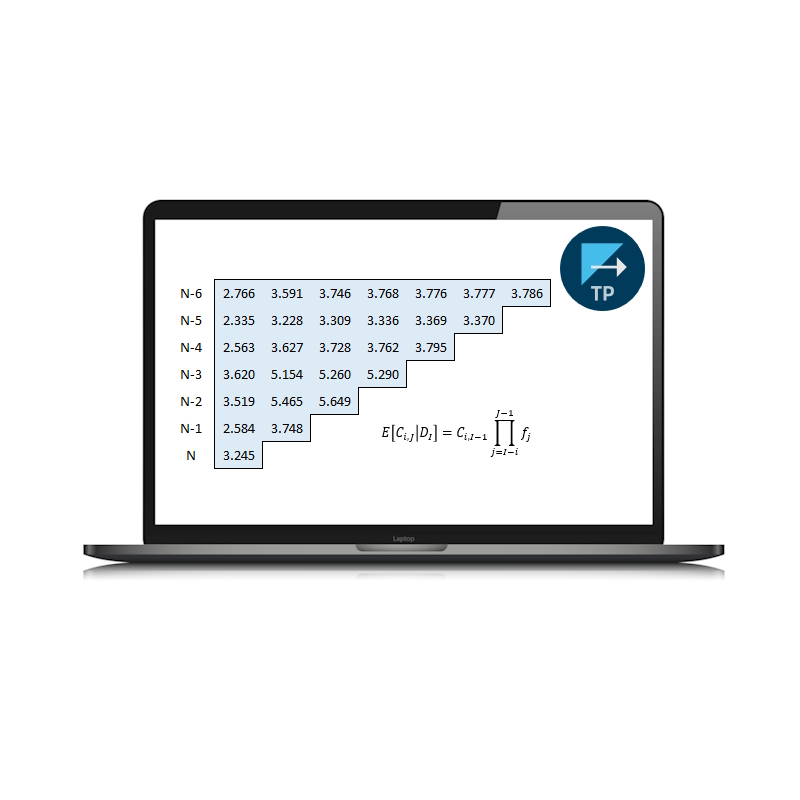

Vårt verktøy for å beregne tekniske avsetninger, ReservingTool, er laget for å håndtere mye praktisk arbeid. Du kan effektivisere prosesser som å fastsette IBNR, diskontering, verdsette skadeavsetninger og mye mer. Du kan til og med lynraskt fylle ut et stort antall kompliserte rapportmaler med den automatiske QRT-generatoren.

IORP-verktøy

Alt du kan gjøre, kan du gjøre bedre. Dette gjelder kanskje også dine rapporteringsrutiner. Vi kan hjelpe til med å bygge full integrasjon, og vårt ReportingTool har et innebygd register for aktivadata slik at du kan hente inn manglende data eller få en second opinion.