SOLO REPORTING TEMPLATES

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.04.02 Information on class 10

-

S.04.03 Basic Information – list of underwriting entities

-

S.04.04 Activity by country – location of underwriting

-

S.04.05 Activity by country – location of risk

-

S.05.01 Prem., claims & exp. – lobs

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.06.04 Climate change-related risks to investments

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.12.01 Life & health SLT TP

-

S.12.02 Life TP – by country

-

S.13.01 Cash flows – life

-

S.14.01 Life obligations analysis

-

S.14.02 Non-Life obligation analysis

-

S.14.03 Cyber underwriting risk

-

S.16.01 Ann. stemming from non-life

-

S.17.01 Non-life & health NSLT TP

-

S.17.03 Non-Life Technical Provisions – By country

-

S.18.01 Cash flows – non-life

-

S.19.01 Non-life claims triangles

-

S.20.01 Movements of RBNS claims

-

S.21.01 Loss distrib. profile – non-life

-

S.21.02 Underwriting risks – non-life

-

S.21.03 Non-life mass risks

-

S.22.01 LTG and Transitional Measures

-

S.22.04 Information on the transitional on interest rates calculation

-

S.22.05 Overall calculation of the transitional on technical provisions

-

S.22.06 BE subject to volatility adjustment by country and currency

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.28.01 MCR – Non-composites

-

S.28.02 MCR – Composites

-

S.29.01 AoM – Excess of assets over liab.

-

S.29.02 AoM – Investments & fin liabilities

-

S.29.03 AoM – TP

-

S.29.04 AoM – Technical flows vs TP

-

S.30.01 Facultative covers – basic

-

S.30.02 Facultative covers – shares

-

S.30.03 Reinsurance program – basic

-

S.30.04 Reinsurance program – shares

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

GROUP REPORTING TEMPLATES

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.05.01 Premiums, claims and expenses by line of business

-

S.05.02 Premiums, claims and expenses by country

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.22.01 LTG and Transitional Measures

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.32.01 Undertakings in the scope of the group

-

S.33.01 Insurance and Reinsurance individual requirements

-

S.34.01 Other regulated and non-regulated financial undertakings

-

S.35.01 Contribution to group Technical Provisions

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

-

S.37.01 Risk concentration - Exposure to Counterparties

-

S.37.02 Risk concentration - Exposure by currency, sector, country

-

S.37.03 Risk concentration - Exposure by asset class and rating

REGULATORY FRAMEWORK

GUIDELINES

-

Valuation of Technical Provisions

-

Contract Boundaries

-

Legal Entity Identifier

-

PEPP supervisory reporting

-

IT and Communication Security and Governance

-

Outsourcing to cloud service providers

-

Preparatory: Product oversight and governance arrangements by insurance undertakings and distributors

-

IDD: Insurance-based investment products

-

Risk Factors

-

Prudential Assessment of Acquisitions of Holdings in the Financial Sectors

-

Dialogue between Insurance Supervisors and Statutory Auditors

-

Supervision of branches of thirdcountry insurance undertakings

-

Errata: Supervision of branches of third country insurance undertakings

-

Financial Stability (14 September 2015)

-

Financial stability (18 June 2017)

-

Financial Stability (31 December 2023)

-

Extension of the Recovery Period

-

Long-term guarantee measures

-

Determining the market shares for reporting

-

Reporting and public disclosure

-

Valuation of assets and liabilities other than TP

-

Own Risk Solvency Assessment (ORSA)

-

Exchange of information within colleges

-

Health catastrophe risk sub-module

-

Look-through approach

-

Operational functioning of colleges

-

Ring-fenced funds

-

Supervisory review process

-

Loss-absorbing capacity for the SCR

-

Equivalence assessments by NSAs under SII

-

Market and counterparty exposures in the standard formula

-

Use of internal models

-

Treatment of related undertakings, including participations

-

Undertaking-Specific Parameters

-

Classification of Own Funds

-

Group Solvency

-

Ancillary Own Funds

-

Application of Outwards Reinsurance

-

Application of the Life Underwriting Module

-

Basis Risk

-

System of Governance

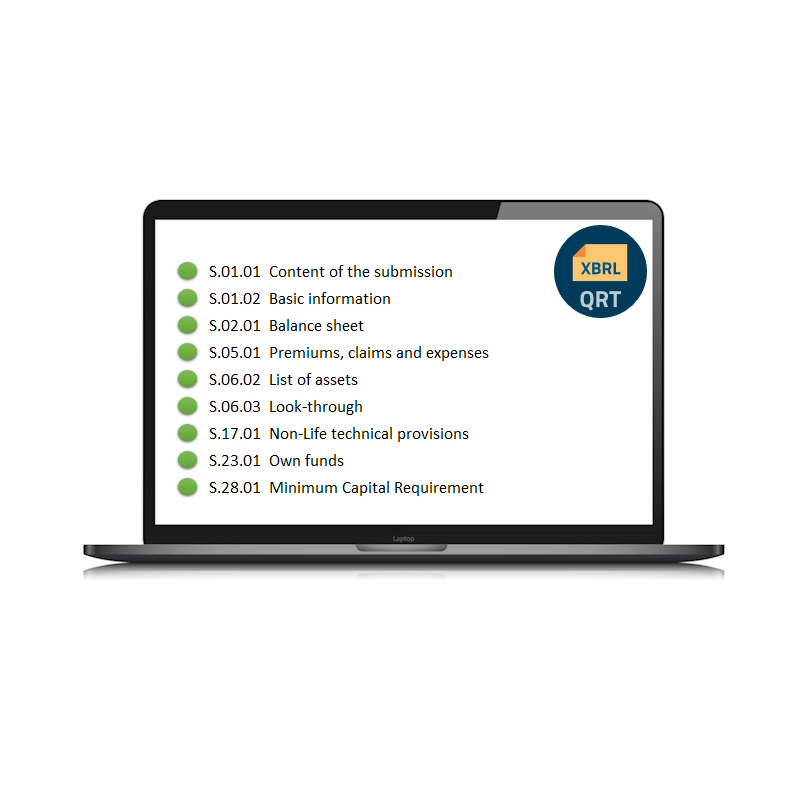

Reporting tool

Our tool for reporting under Solvency II, QRT-Tool, comes with all the service and support you need. And with tight deadlines it is ever-so important to get the right advice to solve issues with your reporting to the financial supervisors. We provide our support via phone, email or with online meetings and we are even often available at hours you had never expected.

SCR calculation tool

Our tool for calculating the Solvency Capital Requirement under Solvency II, SCR-Tool, is intuitive and simple to use. SCR-Tool comes with a powerful overview, and you can easily drill down in any component of the calculation. You can see the formulas, and results are presented exactly in the format, which is used in the QRTs. Nothing is hidden.

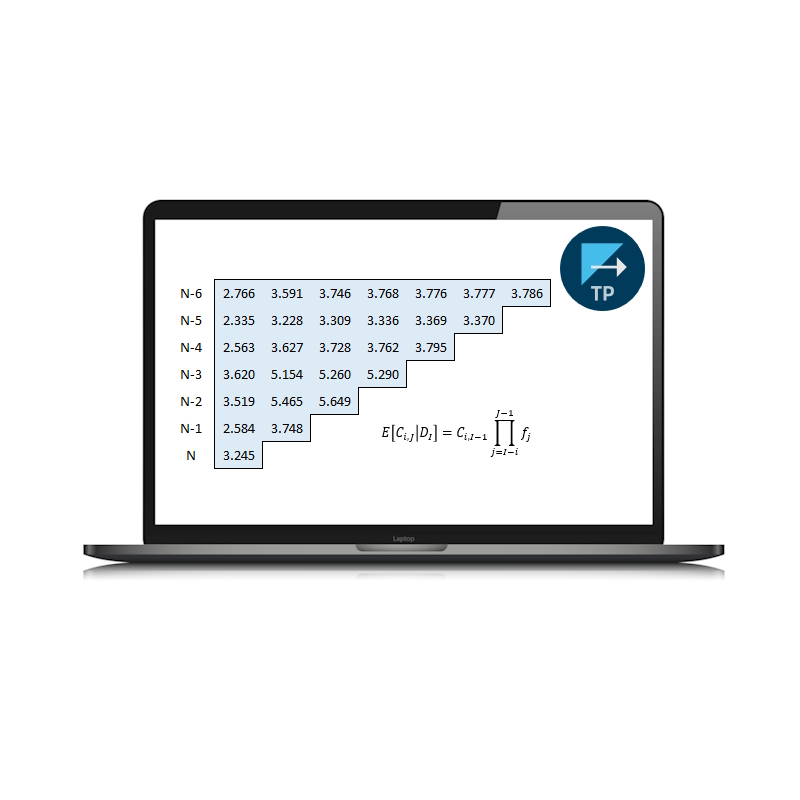

Reserving tool

Our tool for calculating technical reserves, ReservingTool, is made to complete a lot of practical work. So, you can speed up the processes setting the IBNR, discounting, valuating claim handling reserves and much more. You can even lightning-fast populate a whole number of complicated reporting templates with the automatic QRT-Generator.

IORP tool

Anything you can do, you can do better. This may apply to your reporting routines as well. We can assist in building full integration and our ReportingTool has an embedded asset data repository so you can pull in missing asset data or get a second opinion.