SOLO-RAPPORTMALLAR

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.04.02 Information on class 10

-

S.04.03 Basic Information – list of underwriting entities

-

S.04.04 Activity by country – location of underwriting

-

S.04.05 Activity by country – location of risk

-

S.05.01 Prem., claims & exp. – lobs

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.06.04 Climate change-related risks to investments

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.12.01 Life & health SLT TP

-

S.12.02 Life TP – by country

-

S.13.01 Cash flows – life

-

S.14.01 Life obligations analysis

-

S.14.02 Non-Life obligation analysis

-

S.14.03 Cyber underwriting risk

-

S.16.01 Ann. stemming from non-life

-

S.17.01 Non-life & health NSLT TP

-

S.17.03 Non-Life Technical Provisions – By country

-

S.18.01 Cash flows – non-life

-

S.19.01 Non-life claims triangles

-

S.20.01 Movements of RBNS claims

-

S.21.01 Loss distrib. profile – non-life

-

S.21.02 Underwriting risks – non-life

-

S.21.03 Non-life mass risks

-

S.22.01 LTG and Transitional Measures

-

S.22.04 Information on the transitional on interest rates calculation

-

S.22.05 Overall calculation of the transitional on technical provisions

-

S.22.06 BE subject to volatility adjustment by country and currency

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.28.01 MCR – Non-composites

-

S.28.02 MCR – Composites

-

S.29.01 AoM – Excess of assets over liab.

-

S.29.02 AoM – Investments & fin liabilities

-

S.29.03 AoM – TP

-

S.29.04 AoM – Technical flows vs TP

-

S.30.01 Facultative covers – basic

-

S.30.02 Facultative covers – shares

-

S.30.03 Reinsurance program – basic

-

S.30.04 Reinsurance program – shares

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

GRUPPRAPPORTMALLAR

-

S.01.01 Content of the submission

-

S.01.02 Basic information

-

S.01.03 Basic Information RFF & MAP

-

S.02.01 Balance sheet

-

S.02.02 Assets & liabilities by currency

-

S.03.01 Off BS – general

-

S.05.01 Premiums, claims and expenses by line of business

-

S.05.02 Premiums, claims and expenses by country

-

S.06.02 List of assets

-

S.06.03 Collective investment undertakings - look-through approach

-

S.07.01 Structured products

-

S.08.01 Open derivatives

-

S.09.01 Profit & loss

-

S.10.01 Securities lending & repos

-

S.11.01 Assets held as collateral

-

S.22.01 LTG and Transitional Measures

-

S.23.01 Own funds

-

S.23.02 Own funds – details

-

S.23.03 Own Funds – movements

-

S.23.04 Own funds – list of items

-

S.24.01 Participations

-

S.25.01 SCR – Standard formula

-

S.25.05 SCR – for undertakings using an internal model (partial or full)

-

S.26.01 SCR – market risk

-

S.26.02 SCR – counterparty default risk

-

S.26.03 SCR – life underwriting risk

-

S.26.04 SCR – health underwriting risk

-

S.26.05 SCR – non-life underwriting risk

-

S.26.06 SCR – operational risk

-

S.26.07 SCR – simplifications

-

S.26.08 SCR – for undertakings using an internal model (partial or full)

-

S.26.09 Internal model: Market and Credit risk – for financial instruments

-

S.26.10 Internal model – Credit event risk Portfolio view details

-

S.26.11 Internal model – Credit risk details for financial instruments

-

S.26.12 Internal model – Credit risk Non-Financial Instruments

-

S.26.13 Internal model – Non-life & Health NSLT Underwriting risk

-

S.26.14 Internal model – Life and Health underwriting risk

-

S.26.15 Internal model – Operational risk

-

S.26.16 Internal model – Model Changes

-

S.27.01 SCR – Non-life catastrophe risk

-

S.31.01 Share of reinsurers

-

S.31.02 Special purpose vehicles

-

S.32.01 Undertakings in the scope of the group

-

S.33.01 Insurance and Reinsurance individual requirements

-

S.34.01 Other regulated and non-regulated financial undertakings

-

S.35.01 Contribution to group Technical Provisions

-

S.36.01 IGT – Equity-type transactions, debt and asset transfer

-

S.36.02 IGT – Derivatives

-

S.36.05 IGT – Profit and loss transactions

-

S.36.06 IGT – Cost Sharing, contingent liabilities, off BS and other items

-

S.36.07 IGT – Internal reinsurance

-

S.37.01 Risk concentration - Exposure to Counterparties

-

S.37.02 Risk concentration - Exposure by currency, sector, country

-

S.37.03 Risk concentration - Exposure by asset class and rating

REGELVERK

RIKTLINJER

-

Valuation of Technical Provisions

-

Contract Boundaries

-

Legal Entity Identifier

-

PEPP supervisory reporting

-

IT and Communication Security and Governance

-

Outsourcing to cloud service providers

-

Preparatory: Product oversight and governance arrangements by insurance undertakings and distributors

-

IDD: Insurance-based investment products

-

Risk Factors

-

Prudential Assessment of Acquisitions of Holdings in the Financial Sectors

-

Dialogue between Insurance Supervisors and Statutory Auditors

-

Supervision of branches of thirdcountry insurance undertakings

-

Errata: Supervision of branches of third country insurance undertakings

-

Financial Stability (14 September 2015)

-

Financial stability (18 June 2017)

-

Financial Stability (31 December 2023)

-

Extension of the Recovery Period

-

Long-term guarantee measures

-

Determining the market shares for reporting

-

Reporting and public disclosure

-

Valuation of assets and liabilities other than TP

-

Own Risk Solvency Assessment (ORSA)

-

Exchange of information within colleges

-

Health catastrophe risk sub-module

-

Look-through approach

-

Operational functioning of colleges

-

Ring-fenced funds

-

Supervisory review process

-

Loss-absorbing capacity for the SCR

-

Equivalence assessments by NSAs under SII

-

Market and counterparty exposures in the standard formula

-

Use of internal models

-

Treatment of related undertakings, including participations

-

Undertaking-Specific Parameters

-

Classification of Own Funds

-

Group Solvency

-

Ancillary Own Funds

-

Application of Outwards Reinsurance

-

Application of the Life Underwriting Module

-

Basis Risk

-

System of Governance

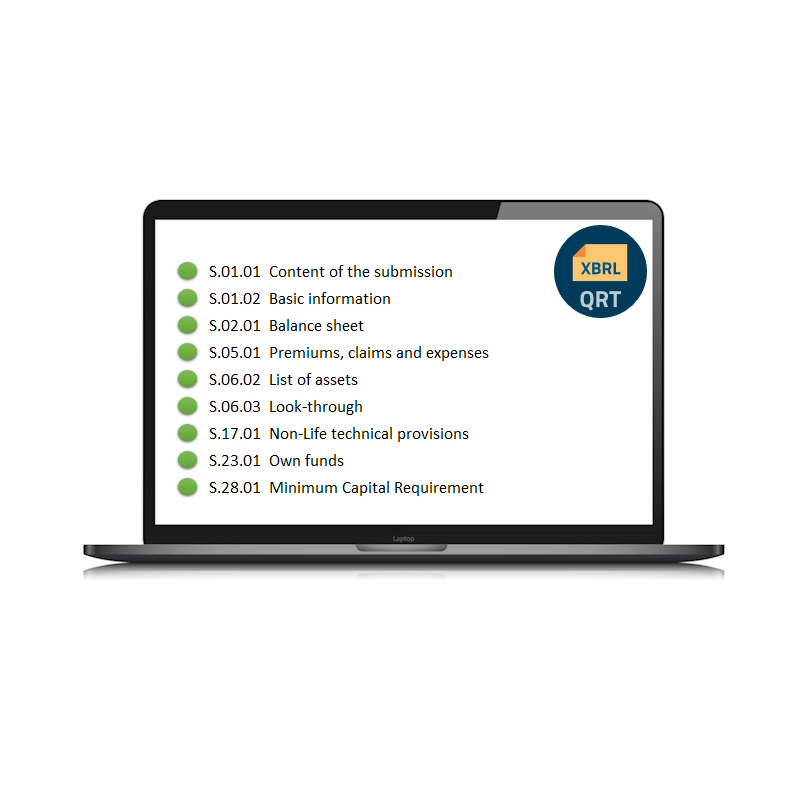

Rapporteringsverktyg

Vårt verktyg för rapportering enligt Solvency II, QRT-verktyget, kommer med all service och support du behöver. Och med snäva tidsfrister är det extra viktigt att få rätt rådgivning för att lösa problem med din rapportering till finansinspektionen. Vi erbjuder support via telefon, e-post eller online-möten och är ofta tillgängliga vid tider du aldrig hade förväntat dig.

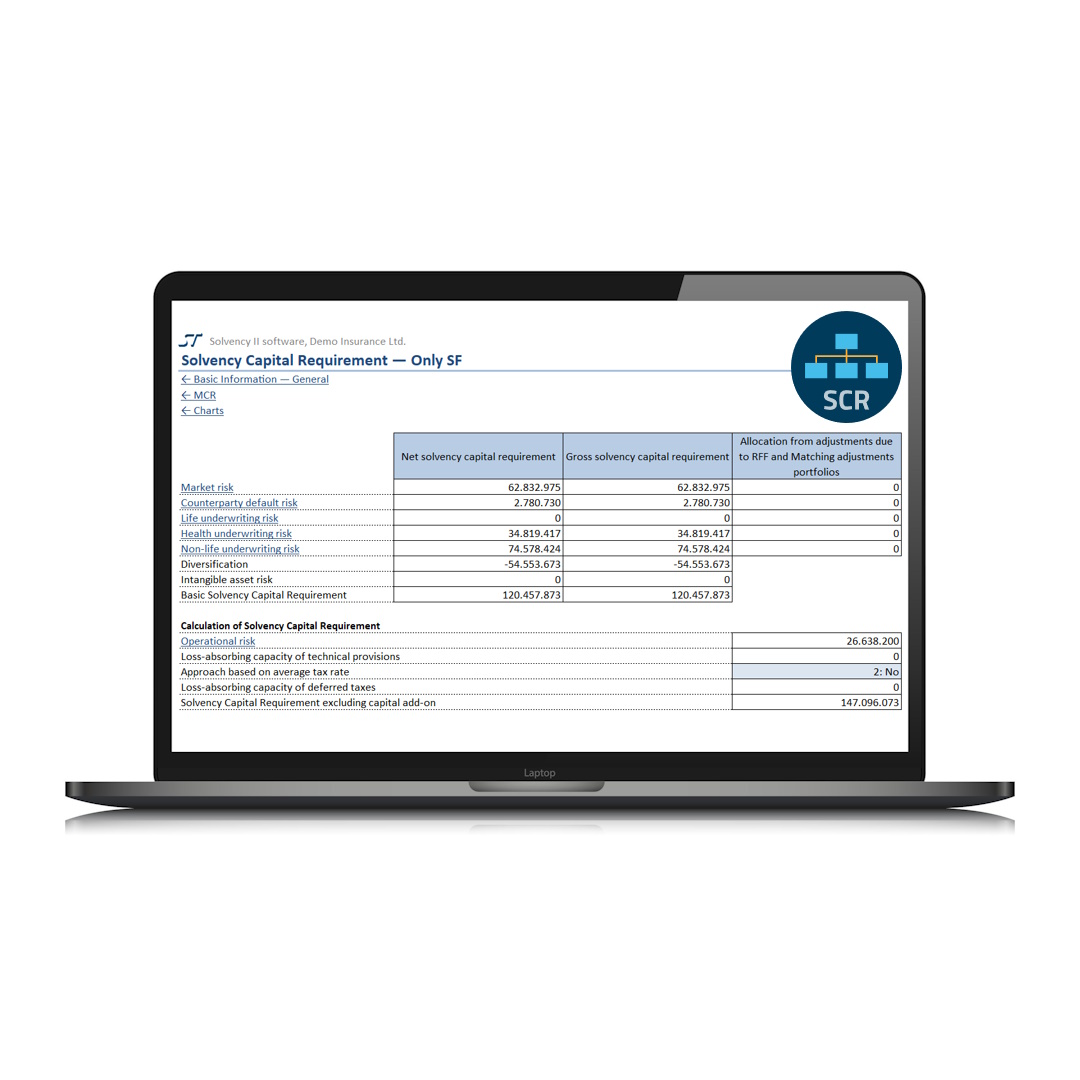

SCR-beräkningsverktyg

Vårt verktyg för att beräkna Solvency Capital Requirement enligt Solvency II, SCR-verktyget, är intuitivt och enkelt att använda. SCR-verktyget ger en kraftfull översikt, och du kan enkelt granska varje komponent i beräkningen. Du kan se formlerna och resultaten presenteras exakt i det format som används i QRT:erna. Ingenting är dolt.

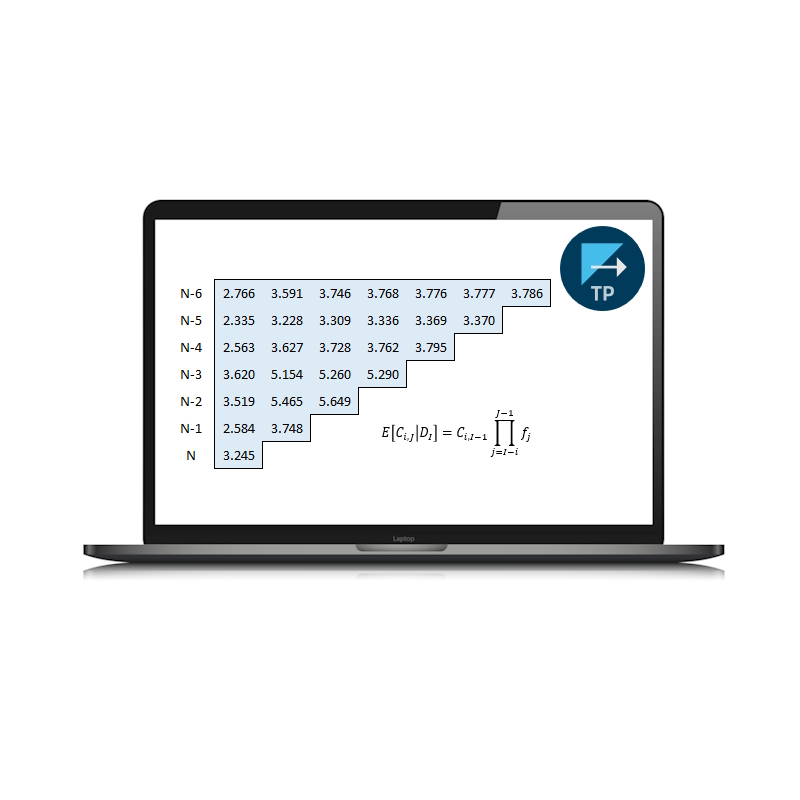

Reserveringsverktyg

Vårt verktyg för att beräkna tekniska avsättningar, ReservingTool, är gjort för att hantera mycket praktiskt arbete. Du kan snabba upp processer som att fastställa IBNR, diskontering, värdera skadeavsättningar och mycket mer. Du kan till och med supersnabbt fylla i ett stort antal komplicerade rapportmallar med den automatiska QRT-generatorn.

IORP-verktyg

Allt du kan göra kan du göra bättre. Detta gäller kanske även dina rapporteringsrutiner. Vi kan hjälpa till med att bygga fullständig integration, och vårt ReportingTool har ett inbyggt register för tillgångsdata så att du kan hämta saknade tillgångsdata eller få en second opinion.